Frequently Asked Questions

DISCLAIMER

Please note that the information contained here may vary based on the specific offer of investment extended to an individual company. Your actual rates, payment amounts, conversion specifics and overall financial calculations may vary from what is presented here. This information is presented as a way to help you understand how our process works in general and should not be taken as a guarantee or firm representation of what your deal may look like. You should consult with appropriate legal and accounting and tax professionals before accepting any offer of investment so that you understand the specific deal and its effects on you and your company. While we have tried to make this section as accurate as possible, ECC makes no warranty of any kind as to the information contained herein and will accept no responsibility for this content as it is purely illustrative and explanatory and may not represent the actual terms of an investment made by the company.

Our Process

We’re glad you’re here, and we’re looking forward to answering your questions and potentially getting a chance to work together.

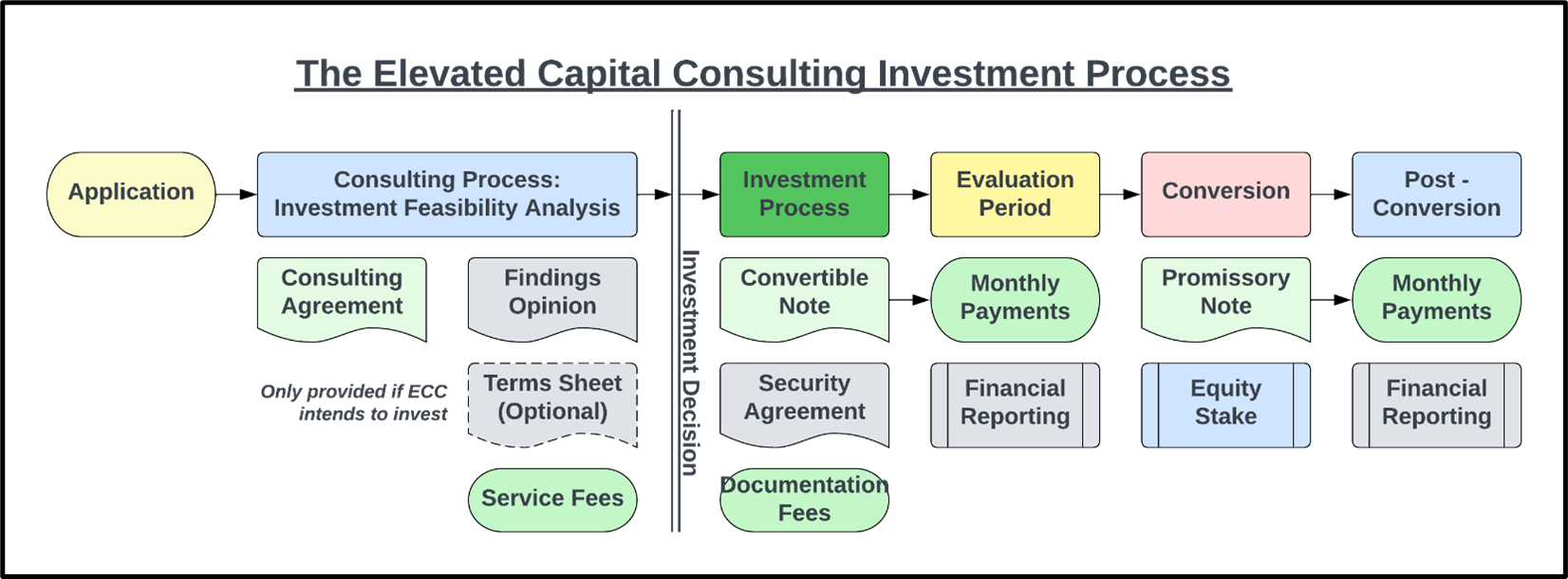

Here is a deeper look at our consulting and investing process that addresses many of the frequently asked questions about working with us to help you pursue your entrepreneurial aims. Please do take notice of our legal disclaimers and policies on the company’s legal page.

Before we dive into the consulting and investment process we follow with all our clients, let’s start with one of the most frequent questions we get: Why do we refer to ECC as a “consulting and investing” company rather than just calling ourselves an angel investor fund or a venture capital company?

Well, in many ways, we are exactly like an angel investor fund and we’re also similar in some respects to a venture capital company. But we’re also different. We are starting simple with a single consulting offering that provides anyone that is starting a company and needs to know whether or how investable their company idea is. But we expect we will find other ways to assist aspiring entrepreneurs with services that help them secure the funding they need without having to give away almost everything to the money people. We believe we have a lot to offer the entrepreneurs that choose to work with us. We aspire to disrupt the funding models that currently exist with something that enables entrepreneurs to keep more of what they build.

Here's a more in-depth look at our consulting and investing process with answers to many of the questions you may have for each step in the process.

APPLICATION PROCESS

This is how you introduce yourself, your company, and your project to us. The application form is simple, straightforward, and easily accessible on our website and covers much of the basic information we need in order to start the consulting and investment process.

|

Q: Why do we need a “Project Name”? A: That’s to help identify a project and to ensure confidentiality. By referring to a project with a project name that doesn’t include a company name or another identifying piece of information, we can talk about Project Acme and even though we may discuss details, nobody who is not part of the consulting and evaluation process or the investment process will know what is being discussed. It also helps with clients who may be asking for different investments for specific pursuits they need funding for. For example, one client of ECC may have a separate project and investment evaluation request for multiple pursuits. They may be looking for an opinion about a commercial building they are looking to acquire, or another company that they want to purchase and integrate, or they may just be looking to raise funds for organic expansion of their company and need money for ramped-up marketing efforts. It’s easier to refer to these specific needs by using a project name. Q: Why do you need to know our company type and organization state? A: This is to establish our relationship and is part of a normal review of a company’s legal status. We use the information to fill in the consulting agreement and any other agreements that you may execute with ECC. What kind of company you’ve formed and which state you |

choose to form in actually has an impact on how easy it will be to gain additional investors, and how easy or hard it will be to exit the business when the time comes. Entity type and state of formation can also affect your eventual valuation. All of this plays a part in the evaluation we are doing for you. Q: We don’t have a law firm representing us yet. Is that a problem? A: No, but you should have one, especially if you have progressed past the early stages of your company and are working to grow (which is probably why you’re here looking for investment, right?). Q: What if we’re not yet sure how much funding we want? A: Then you’re probably not ready to be contacting us and should wait until you are. A key aspect of whether you are investable or not is whether you know how much you need and what you will use it for. If you don’t know this yet, then you’re not ready to request funds OR a professional assessment of whether you are investment worthy. You are not. Get help with determining how much you need, for what purposes, and what the goal of the investment will be, then get back in touch with us. |

CONSULTING REVIEW

If we review your application and want to proceed further, the first thing we will send you is a Consulting Agreement for the Investment Evaluation Services. Once we have your signed agreement back, then we’ll request additional materials and information and proceed with a review of your investment needs.

|

Q: What additional materials are requested for the Consulting Review? A: In addition to the application form information, you will also be asked for the following:

PLEASE NOTE that this may not be an exhaustive list of the materials requested during the consulting engagement and further materials may be requested at the sole option of Consultant. A: Generally speaking, no more than thirty (30) calendar days. Usually, we try to get the review of materials done within ten (10) business days of receiving the additional materials from you. But, especially for the larger investment amount requests, more time may be required to provide a proper opinion on your company’s investment potential. |

Q: How much are the fees for the consulting project? A: Consulting Fees are calculated based on the size of the requested investment. The larger the investment request, the more we review and inspect the materials and the more likely we dig into additional information, data, and materials beyond the standard materials request. As a general rule of thumb, you should be expecting the consulting services fees to be about five percent (5%) of the requested investment amount. Q: When do we pay the consulting services fees? A: Consulting service fees are not due until the Findings Opinion has been delivered to you. In other words, we do the work first, then we present you with the deliverables, and then you pay ECC for those deliverables. In certain instances, most often when ECC finds out that a company is not ready for an investment or that they maybe should not have been accepted as an investment consulting client in the first place due to information we uncover as part of the consulting process that ECC may choose to waive the services fees. Such a fees waiver is at our sole discretion and will be communicated with the investment findings opinion. Q: Do we still have to pay consulting fees even if ECC decides to invest in our company? A: Yes. However, realize that those service fees are a large part of the reason we are able to provide our investment funds at such a low cost to you. You may have to pay a service fee for an investment opinion, but those fees help us keep the cost of our investment funds lower than just about any other investment funding you will find anywhere else. And they help us ensure that people who are seeking investment are truly confident in their business plans, are putting their own funds on the line to advance those plans, and are not just rolling the dice with our money. |

FINDINGS OPINION

We provide a summary opinion of our findings as the deliverable for the consulting services. The Findings Opinion summarizes the materials that we reviewed and provides information about what we saw in those materials that either led us to a conclusion that your business was worthy of investment or not.

|

Q: What if I don’t need a findings opinion or consulting services? A: The consulting services are part of our operational model and are not optional. If you would prefer not to go through the consulting process and are not interested in getting a findings opinion on your business, then ECC may not be the right consulting and investment firm for you. As mentioned above, the paid consulting services is part of the reason we are able to offer investment funding at such a low cost. Q: What kind of information can we expect to see in the findings opinion? A: Our opinion on the quality of the information provided and whether we believe your business is worthy of investment or not. We will provide feedback on the completeness of the information provided as well as our opinions on what aspects of those materials led us to conclude whether your business is worthy of investment or not. And if |

you were not worthy of investment, generally we will provide you with feedback about why and what you might be able to do to overcome that negative opinion. Q: What if we disagree with the information in the findings opinion? A: If you believe we have misinterpreted the information you sent us, we are open to evaluating updated materials. However, remember that the findings opinion is just that: our opinion based on our years of collected experience working with entrepreneurs and as entrepreneurs ourselves. You may not like our findings, but we do our best to give you the kind of unvarnished feedback that will hopefully help you improve your approach, your materials, and your success in getting investment funding. |

OFFER OF INVESTMENT

If, after completing our consulting process and providing you with a positive investment findings opinion, we decide that your business is the kind of investment we would like to make, then along with your consulting deliverable we will also provide you with a terms sheet. The terms sheet defines the terms and conditions upon which we would make an investment in your company.

|

Q: What if I didn’t get a terms sheet? A: Then we have decided not to invest in your business. Many factors can affect whether we decide to make an investment or not. In general, those factors will be provided in the findings opinion. Q: What if I don’t like the terms provided on the terms sheet? A: You are welcome to request changes. We will seriously consider all requests for modifications to the terms, but we also reserve the right to decline to make an investment if we don’t agree with your requested changes. Please keep in mind that we are doing our best to provide an investment model that is “entrepreneur friendly” and that the funds we offer, when we offer them, are likely to be the least expensive investment funds you will find anywhere. Unfortunately, that may mean you have to agree to a few terms that make our investments possible but that you may not necessarily like. Accepting the investment is completely up to you. You are under no obligation whatsoever to accept our offer of investment. |

Q: Can I get a sample terms sheet to review? A: Yes. Anyone who signs up for consulting services may request a generic version of the terms sheet to review with their legal counsel. If you determine as part of this review that you are not interested in receiving funding under those terms, you may cancel the consulting services engagement and we will cancel the consulting services agreement, no questions asked. Q: How do I accept an offer of investment? A: Sign and return the terms sheet to us. We will then start the funding process and get you the documents that are part of that process to review with your attorney. |

INVESTMENT, FUNDING, AND THE CONVERTIBLE NOTE

If you accept our offer of investment, the next step is the investment or funding process. This involves completing all of the required documentation for the investment, including a convertible note and a security agreement. The funding process can take up to ninety (90) days to complete, but we usually get it done quite a bit faster than that.

|

Q: How are investments made? A: We invest funds against a convertible note issued by your company. You will receive a wire transfer equal to the funding amount described in the convertible note once the note and the security agreement is fully executed and we file a financing statement (UCC-1) in the state where your company is organized. We will provide you with the convertible note and security agreement documents to use and we’ll work with you and your legal counsel to get everything executed and completed. Funding takes place as soon as everything is completed and executed. Q: What if we change our mind? A: If we have already proceeded to get documentation in place then you may owe a $8,500 “break-up fee”. Once we get to a certain point in the process much of the costs have already been expended. Q: What is the duration of the convertible note? A: 2 years. Q: What is the interest rate charged on the convertible note? A: We use the Applicable Federal Rates (“AFRs”) plus one tenth of one percent (0.1%) as the interest rate on the convertible note. The AFRs are the lowest interest rate that the IRS allows anyone to provide money at and are updated each month by the IRS (see their website here). Even your Uncle Bob has to pay the AFR on his taxes if he gives you an “interest free” loan. Q: Is there a pre-payment fee on the convertible note? A: Yes there is a 4% pre-payment fee on the note. Q: What is the documentation fee and how much is it? A: The documentation fee is 8% of the invested amount and covers the costs of documentation for the investment. It also helps lower the cost of the investment funds being provided, same as the services fees. |

Q: Do I need to come up with additional cash to pay the documentation fee? A: No – it is financed as part of the convertible note. The documentation fee is added on top of the investment funds that you receive, financed as part of the convertible note, and then subtracted off the top of the note principal amount. So, if you get an investment of $1,000,000, eight percent is $80,000. Your convertible note principal will be $1,080,000, but you will only receive $1,000,000. The $80,000 fee will be financed as part of the convertible note amount. Q: Does ECC ask for security on its investment and if so, what kind? A: We require a security interest in all of the assets of your company or a sufficient amount of the company’s assets that add up to at least the amount of the convertible note. We can discuss the specific assets to be named on the security agreement during the funding process and will ensure that our security agreement does not become an undue burden on your company. We want you to be successful. We want the opportunity to share in that success. But we also need some security that assures us the investment money is not being spent recklessly. We believe getting a security agreement provides an additional level of stewardship and care that helps assure mutual success. Q: Does ECC require a personal guarantee? A: No. The security interest that ECC takes is solely against the assets of your company, not your personal assets. We’re not the SBA and we’re not a bank. We’re investors. We want your business to be successful and we’ll be watching during the convertible note period to determine whether we want to take an equity stake in your company when the note converts. Q: Does ECC require any other oversight or control over my business? A: Only regular financial reporting. This includes providing quarterly and annual unaudited (audited, if available) financial statements including profit and loss, balance sheets, operations reports, and a statement of cash flows. ECC does not require any other oversight, either (i.e., board seats). |

CONVERSION PROCESS

When a conversion event happens (such as a change of control or qualified financing event) or when the convertible note matures, then the note will convert to a longer-term financial relationship. This could be by the outstanding note balance being paid off, or being converted into shares of stock or membership units (an equity stake), or becoming a longer-term promissory note, or some combination of promissory note and equity.

|

Q: What events cause the conversion of the convertible note? A: Three events cause conversion of the note, a “qualified financing” which is an optional conversion event, and a “change of control” and at “maturity”, which are both automatic conversion events. A qualified financing is when you raise money from another investor after you get money from ECC. The conversion is not automatic, it’s at ECC’s option. A change of control occurs when you someone else takes over control of the company (i.e., becomes a more than 50% owner). Maturity occurs when the note gets to 24 months. Q: Into what form does the note convert? A: Into a straight promissory note, or to equity in your company, or some combination of both, at ECC’s option. The straight promissory note is just like a loan you get from a bank. You pay interest and principal on a monthly basis until the term (8 years) is up. Conversion to equity in your company is limited to being less than 49% of the total authorized shares or units in your company – in other words, we don’t want a controlling interest in your company. Depending upon the amount of investment ECC has made in your company, we may split the conversion between a promissory note and equity up to the conversion price. The amount of the conversion, or conversion price, is the principal amount of the convertible note plus any accrued and unpaid interest plus any unpaid fees.

Q: If ECC chooses to convert to equity, how is the share or unit price calculated? A: Shares or units will be priced at a 20% discount off recent share prices or value. More specifically, the share or unit price will be priced at a 20% discount off the price per share in the qualifying financing that led to conversion, or at a 20% discount off the value placed on those shares according to an independent valuation of the company conducted no more than sixty (60) days prior to the conversion. |

Q: Can I simply pay off the convertible note rather than letting it convert? A: Absolutely! If our investment has put your company in a position to simply pay off the investment and keep your gains for yourself, then congratulations! That is the kind of result that ECC will brag about. Q: If the convertible note becomes a promissory note, what are the terms? A: Eight (8) year term with interest rates of AFR + 1%. Monthly payments are standard interest and principal payments with a monthly compounding interest amortization schedule. Q: Do I get to choose how the note converts or is that up to ECC? A: ECC gets to choose how the note converts. At least thirty (30) days prior to the date that the note will convert, whether that is by a qualified financing or a change in control or maturity, you have to reach out to ECC and ask for instructions on how to handle the conversion. ECC will provide you with the conversion method and breakdown and provide you with draft documents to use for the conversion process (just like with the issuance of the convertible note). Note that the simplest alternative to conversion is to simply pay off the note. |

POST CONVERSION

After the convertible note reaches maturity or converts, you will have either issued stock or membership units to ECC or signed a promissory note or some combination of both for the outstanding amount of your convertible note. After that you will only pay regular monthly payments for the promissory note amount and will treat ECC just like another shareholder or member.

|

Q: Is there a security agreement required for the promissory note? A: Yes. The same form of security agreement as was executed for the convertible note will be executed for any promissory note that is put in place post-conversion. It will again be on all of the assets of the company or any amount of specific assets that is sufficient to cover the amount of the promissory note. Q: What are the terms of the promissory note? A: The promissory note has an eight (8) year maturity with interest compounded monthly at AFR plus 1%. You will make monthly payments of principal and interest using a standard amortization schedule. Q: Who prepares the promissory note? |

A: ECC prepares the promissory note for your execution. We have created all of the documentation necessary to complete the investment processes that we work through with our clients and put them in place at each stage of the process where they are needed. This is to make the investment process as simple and straightforward as possible for both you as our client and us as your investor. Q: How is conversion to equity handled? A: This depends on the corporate or company agreements you have in place. We will follow the provisions of your corporate by-laws or limited liability company operating agreement and will assist in the preparation of any documents that need to be generated or executed in order to effect the issuance of equity shares or membership units. Note that we will likely ask to see those formation and governance documents as part of the consulting process as those not only affect this future conversion but also help us understand whether your company is properly prepared for investment overall. |

INVESTMENT SUMMARY

Compared to a standard bank or private money loan or to a standard venture capital investment, getting an investment from ECC could be the best financial solution for your business. Consider the following comparison for an investment amount of $3,000,000.

|

|

Standard Bank Loan |

Traditional Venture Capitalist Fund |

Elevated Capital Consulting (ECC) |

|

Down Payment or Other Upfront Fees Required? |

YES - At least 10%; Often 20%+ |

NO |

YES 5% Services Fee |

|

Other Pre-Funding Fees? |

YES – Origination fees, initiation fees, points |

NO |

YES 8% Documentation Fee |

|

Interest Rate Charged |

Currently 9.5% - 15%[1] |

May exceed 30%[2] |

YES – AFR[3] + 1% (As of 5/23 – 4.31%) |

|

Compounding Period |

Monthly |

Monthly |

Monthly |

|

Term |

7 - 10 years[4] |

12 – 24 months for convertible note; Long term equity holder |

2 years convertible note 8 years promissory note 10 years overall |

|

Monthly Payment |

Standard Amortization Schedule – Monthly Payments |

None until maturity; Goal is for conversion to preferred equity |

· Minimal (Interest Only) Monthly Payment on Convertible Note; · Standard Amortization for Promissory Note; · No requirement for equity conversion – optional for ECC |

|

Conversion Terms |

None – straight debt |

· Qualifed Financing; · Change of Control; · Maturity |

· Qualifed Financing; · Change of Control; · Maturity |

|

Converts into |

N/A |

Discounted Preferred Equity unless paid in full |

Straight Debt or Discounted Equity (common stock or units) or Both, unless paid off |

|

Prepayment Fee |

Usually ~3-5% |

NO |

Yes – 4% on both convertible and any promissory note |

|

Personal Guaranty |

YES – Full Amount of Loan |

NO |

NO |

|

Take Controlling Interest? |

NO – Debt only |

Often: YES |

NO – limited to 49% |

|

Security Interest |

Lien on Corporate Assets |

Controlling Interest; Board of Directors Seat |

Lien on Corporate Assets |

Sample Ecc Investment Scenario

If you are selected to receive an investment from ECC, the following table should give you an idea of the total costs of the investment for your company based on a $3,000,000 investment with the assumption that ECC decides NOT to convert any of the investment to equity at the end of the convertible note period.[5]

[1] Based on May 2023 SBA loan rates published at https://www.bankrate.com/loans/small-business/sba-loan-rates/#current.

[2] Based on article about venture capital investing published at https://www.upcounsel.com/venture-capital-interest-rates.

[3] AFR = Applicable Federal Rate as published monthly by the IRS and posted at https://www.irs.gov/applicable-federal-rates.

[4] Based on May 2023 SBA loan terms that depend on the use of proceeds as published at https://sba.gov.

[5] DISCLAIMER ON INVESTMENT CHART: This is just an example. Each investment scenario is different and your actual results may vary from the example. This is for illustration purposes only and does not constitute a guarantee of any kind. Additionally, interest rates may change and certain calculations are built specifically for this model. You should consult with an accounting professional and perform your own analysis before agreeing to accept an investment from ECC. We accept no responsibility for any errors in this document or this table.